Breaking: Trump Media’s Bold Crypto Play – Truth Social Owner Eyes Bakkt Acquisition

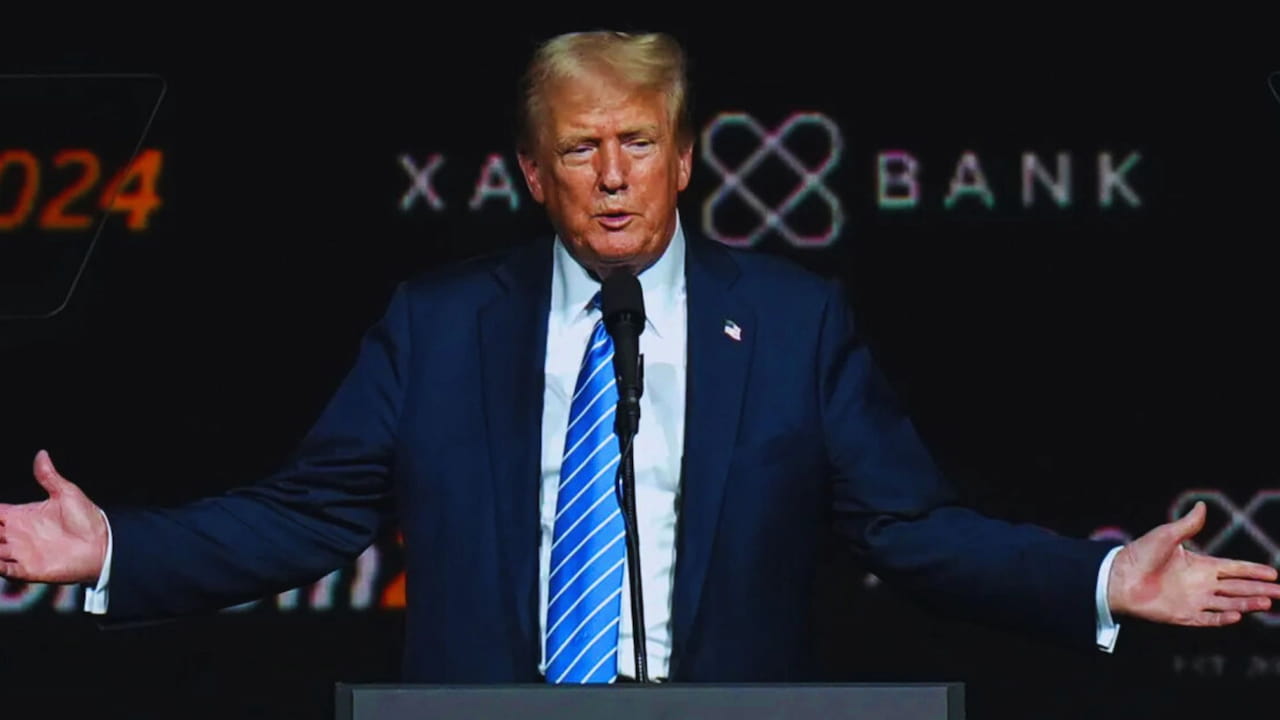

In a groundbreaking development that has sent shockwaves through both the social media and cryptocurrency sectors, Trump Media & Technology Group (TMTG) is reportedly in advanced negotiations to acquire crypto trading platform Bakkt in an all-stock deal. This potential merger marks a significant shift in the digital landscape as we approach 2025.

As a veteran financial reporter covering this story, I can tell you that Wall Street’s reaction has been nothing short of explosive. Bakkt’s stock skyrocketed by an astounding 162% following the news, while TMTG’s shares climbed more than 16% in a single trading session.

The timing of this move is particularly interesting. President-elect Donald Trump, who owns roughly 60% of TMTG, has recently shown increasing interest in the cryptocurrency space. Just weeks before his election victory, Trump launched World Liberty Financial, a new crypto venture where his family stands to earn 75% of net coin revenue.

Let’s break down what this means for investors and the market:

The Players Involved

- Trump Media & Technology Group (DJT)

- Operates the Truth Social platform

- Current market value: $7.1 billion

- Cash reserves: $673 million

- Recent quarterly loss: $19.25 million

- Bakkt (BKKT)

- Founded: 2018

- Latest quarterly revenue: $328.4 million

- Operating loss: $27.4 million

- Market cap: Approximately $190 million

Market Impact

The cryptocurrency market has responded positively to these developments. Bitcoin has pushed past $91,000, showing strong momentum in the crypto space. Other crypto-related companies have also seen significant gains:

- MicroStrategy jumped 13% after buying more bitcoin.

- Coinbase surged over 6%.

- The entire crypto sector shows renewed confidence

The Bigger Picture

This potential acquisition isn’t just about combining two companies; it’s about creating a powerful platform that bridges social media and cryptocurrency trading. The deal would bring together:

- Truth Social’s social media reach

- Bakkt’s crypto trading technology

- TMTG’s substantial cash reserves

- Experienced leadership from both sides

Notable Connections

An interesting detail that adds depth to this story is the connection between key players. Kelly Loeffler, who previously served as Bakkt’s CEO, is now co-chairing Trump’s inauguration committee. She’s married to Jeffrey Sprecher, the CEO of Intercontinental Exchange, which owns both Bakkt and the New York Stock Exchange.

Looking Ahead

While this deal shows promise, there are some challenges to consider. Bakkt has faced recent struggles, including:

- A warning about its ability to continue as a going concern

- A previous NYSE delisting warning

- The need for a reverse stock split in April

However, with TMTG’s strong cash position and Trump’s growing influence in the crypto space, this merger could provide Bakkt with the stability and resources it needs to thrive.

The potential acquisition represents a bold move into the cryptocurrency space by TMTG, potentially creating a unique platform that combines social media engagement with crypto trading capabilities. As this story develops, market watchers will be keeping a close eye on how this merger could reshape the digital asset landscape in the coming years.

Remember: The crypto market is known for its volatility, and while today’s news has created significant market movement, investors should always approach such developments with careful consideration of their risk tolerance and investment goals.