Market Momentum Cools as Wall Street Reassesses Trump Victory Rally

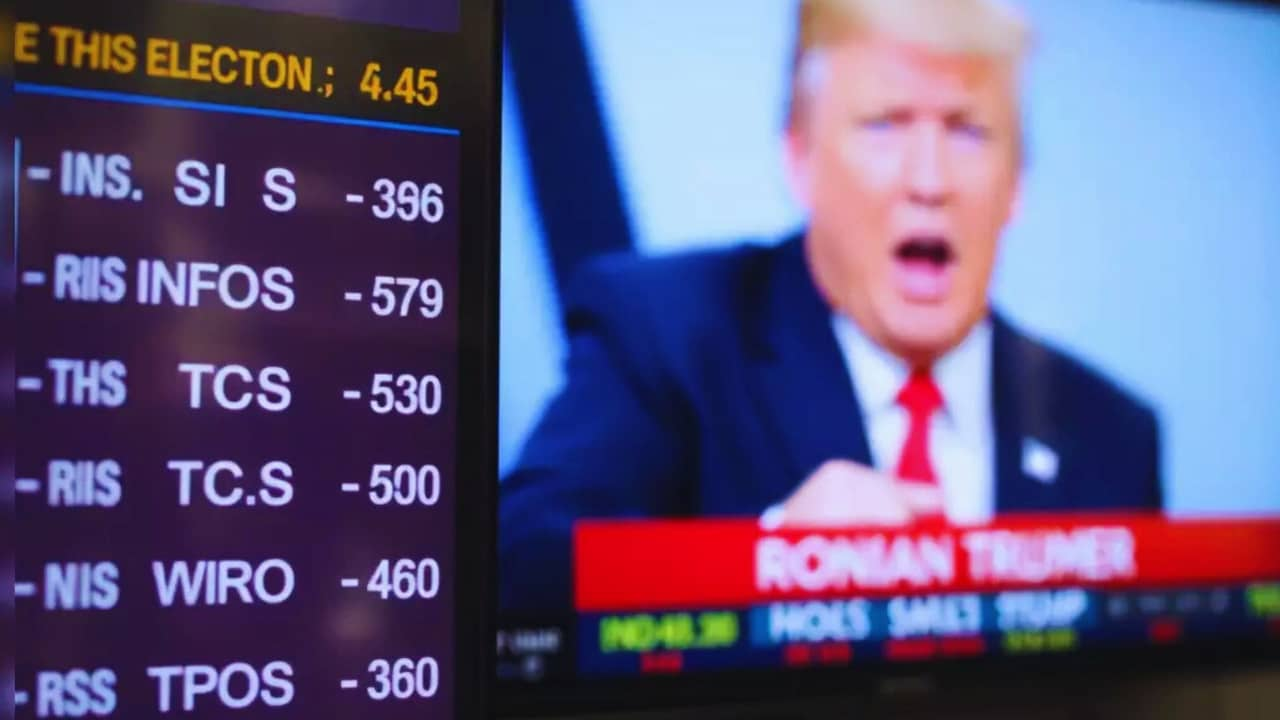

This week, investors grappled with mixed signals about the economy and future interest rate cuts, putting a halt to Wall Street’s post-election euphoria. The S&P 500 tumbled 2% for the week, marking a significant shift from last week’s powerful rally that followed Donald J. Trump’s presidential victory.

The market’s retreat comes as investors digest both the implications of Trump’s upcoming presidency and cautionary comments from Federal Reserve Chair Jerome Powell, who indicated the central bank isn’t rushing to cut interest rates further.

Market Snapshot

- The S&P 500 dropped 1.3% on Friday, closing at 5,870.62.

- The Dow Jones Industrial Average fell 305.87 points to 43,444.99.

- The tech-heavy Nasdaq saw the steepest decline, sinking 2.24% to 18,680.12.

- Bitcoin surged past $90,000, hitting a new record.

The healthcare sector takes a hit

The healthcare sector led the week’s losses, tumbling 5.3% after Trump named Robert F. Kennedy Jr. as his pick for Health Secretary. Major pharmaceutical companies felt the impact:

- Moderna shares plunged 7.3%.

- Pfizer dropped 5%.

- Amgen fell 4.2%.

Tech giants stumble

Big tech stocks, which had been market leaders, faced significant pressure.

- Nvidia shares dropped over 2%.

- Meta Platforms declined.

- Microsoft and Alphabet pulled back.

- Tesla bucked the trend, rising 3% as a “Trump trade” favorite.

Rate Cut Expectations Cool

Powell’s remarks dampened expectations for swift interest rate reductions. The Fed chair said the economy’s strength means there’s no rush to lower rates. Markets now see:

- The probability of a December rate cut has decreased to 62% from 82% earlier this week.

- We anticipate three quarter-point reductions until 2024.

- 10-year Treasury yield: 4.4%

Consumer Strength Continues

October’s economic data painted a picture of continued consumer resilience:

- Retail sales rose 0.4%, beating the expected 0.3%.

- Consumer spending remains robust.

- Inflation showed a slight uptick in October.

Looking Ahead

Wall Street faces a period of adjustment as the initial election enthusiasm fades. BlackRock’s Kristy Akullian notes: “While we think the macro backdrop still bodes well for risk assets, in the near term we should expect some micro volatility, particularly around potential policy shifts under a new administration.”

The market’s response suggests investors are taking a more measured approach, weighing both opportunities and risks as they look toward 2025. With corporate earnings showing mixed signals and valuations running above historical averages, careful stock selection may become increasingly important.

The dollar’s continued strength, hitting new yearly highs, adds another layer of complexity to the global economic picture. As markets navigate these crosscurrents, volatility could remain elevated in the weeks ahead.